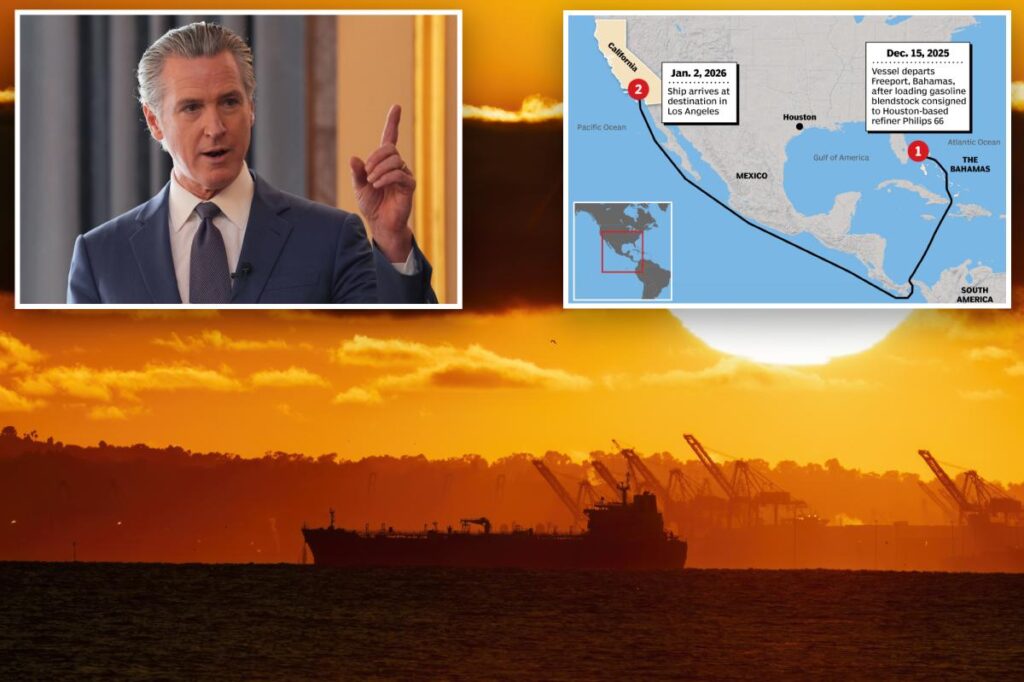

California is increasingly importing gasoline through the Bahamas — a workaround to a 106-year-old US shipping law that forces domestic fuel shipments onto costly American vessels.

More than 40% of the gasoline California imported in November was routed through the Caribbean hub, a record high which comes as drivers in the state are paying an average of $4.58 per gallon, the most in the country, according to Bloomberg News.

Gasoline refined along the US Gulf Coast — primarily in Texas and Louisiana — is first shipped roughly 1,100 to 1,300 nautical miles to Freeport in the Bahamas, where it is stored at large transshipment hubs before being re-exported.

From there, tankers travel another 4,000 to 4,500 nautical miles through the Panama Canal and up the West Coast to Los Angeles or San Francisco.

In total, the voyage spans roughly 5,000 to 6,000 nautical miles, depending on the ports involved.

At typical tanker speeds of 12 to 15 knots, the journey can take two to three weeks, including canal transit and port time.

The added leg builds extra shipping, storage and handling costs into wholesale gasoline prices, which are ultimately passed on to consumers.

While routing fuel through the Bahamas can still be cheaper than chartering scarce US-flagged tankers, the detour adds time, complexity and exposure to volatile global freight rates — all of which can put upward pressure on pump prices in California.

The indirect route is used by suppliers to sidestep the Jones Act.

The 1920 law requires goods transported between US ports to travel on US-built and US-crewed ships.

There are only about 55 Jones Act-compliant tankers worldwide, compared with thousands of foreign-flagged vessels — making direct Gulf Coast shipments to California prohibitively expensive.

Chartering a foreign-flagged tanker has historically been significantly cheaper than using a Jones Act-compliant vessel.

Over the past year, foreign ships were nearly $4 per barrel cheaper than US-flagged tankers for comparable routes, according to freight data cited by Bloomberg.

That cost gap has narrowed recently —to roughly $1 per barrel—after regional freight rates rose.

Still, even a $1 to $4 per barrel difference can translate into meaningful savings on large cargoes, helping explain why suppliers route gasoline through the Bahamas to avoid the higher cost of scarce US-built and US-crewed vessels.

California has had to increase its reliance on fuel shipped from the Atlantic due to the closure of the Phillips 66 refinery in Los Angeles this past October.

The Golden State has seen a wave of refinery closures in recent years due to the rising costs energy companies are forced to bear under more stringent environmental rules.

After Phillips 66 was shuttered, gasoline imports to California climbed to the highest level since 2016, according to Vortex data cited by Bloomberg News.

Golden State motorists may have to pay even more for gas as Valero Energy Corp. is preparing to close a refinery in Northern California this coming spring.

The average is up from $4.478 a week ago and $4.205 a month ago, according to the latest data from AAA.

Prices are still below the $4.841 drivers were paying a year ago, but the recent climb shows steady upward momentum heading into the holiday weekend. Mid-grade is averaging $4.797, premium $4.996, and diesel has crossed the $5 mark at $5.029 per gallon.

The Post has reached out to California Gov. Gavin Newsom’s office for comment.

Read the full article here