Donald TrumpŌĆÖs former national security adviser John Bolton has said he thinks the president’s approach to Venezuela could backfire on his oil goals.

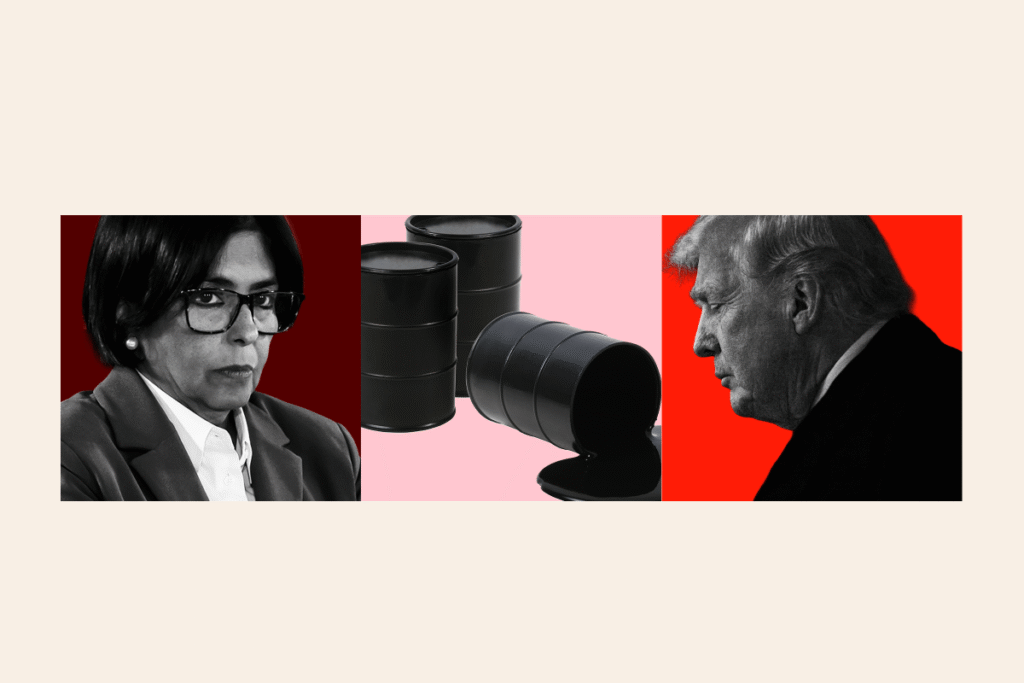

In an interview with Newsweek, Bolton said Trump is more focused on getting an oil deal with Venezuela than toppling Nicol├Īs MaduroŌĆÖs regime, after the U.S. captured him on January 3, for a democratic government.

But this could end up having unintended consequences as it may scare oil companies from investing, he said.

ŌĆ£If I were an oil company executive being pressured by Trump to invest billions of dollars of capital expenditures to revive Venezuela’s oil infrastructure, I would want a regime in place committed to the rule of law,ŌĆØ Bolton, who served in the first Trump administration between April 2018 and September 2019 and later became a vocal critic of the president, said.

Newsweek has contacted the White House via email for comment.

TrumpŌĆÖs Focus on Oil

While the administrationŌĆÖs rhetoric about Maduro was about his involvement in “narcoterrorism” against the U.S. before his capture, oil has quickly become its main focus.

Trump said the South American country will be “turning over” up to 50 million barrelsŌĆöworth over $2 billionŌĆöto the U.S., the proceeds from which he said would be used to benefit the citizens of both countries.

“WeŌĆÖre going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country,” Trump said in a press conference about MaduroŌĆÖs capture on Saturday.

It would cost an estimated $183 billion over the 2026-2040 period to rebuild VenezuelaŌĆÖs dilapidated energy sector, according to the energy and research intelligence company Rystad Energy, but Trump said American oil giants ŌĆ£want to go in so badly.ŌĆØ

Venezuela After Maduro

Bolton argues that American oil companies will want ŌĆ£a democratically elected government with an independent judiciaryŌĆØ rather than ŌĆ£this thugocracy that the Maduro regime represents.ŌĆØ

It is still unclear who will lead Venezuela long-term, but Trump has so-far seemingly opted for MaduroŌĆÖs former vice president Delcy Rodr├Łguez, who was sworn in as acting president last Tuesday.

This came after Trump dismissed the idea of working with Venezuelan opposition leader and 2025 Nobel Peace Prize winner Mar├Ła Corina Machado saying “she doesn’t have the support within or the respect within the country.”

Bolton said this ŌĆ£marks a 180-degree turn from the policy in the first Trump term, which was to work with the Venezuelan opposition,” saying that being invited in by the opposition of a foreign country ŌĆ£legitimizes our action.”

Will Oil Companies Want to Invest in Venezuela?

Bolton went on to say that the state of a government ŌĆ£is the sort of thing that colors any American company considering investment in Venezuela.ŌĆØ

ŌĆ£TheyŌĆÖre just not going to be eager to go in and deal with a regime that 20 years ago nationalized what was left of U.S. oil investments that earlier governments had nationalized in 1976,ŌĆØ he said.

Venezuela formally nationalized its oil industry in 1976, creating the state-owned company PDVSA.

In the late 1990s and 2000s, under President Hugo Ch├Īvez and later Maduro, the government expanded state control of energy sectors and nationalized or restructured foreign oil assets. American firms such as ExxonMobil and ConocoPhillips were forced out of joint ventures when they refused to cede majority control to PDVSA.

After lengthy arbitration and legal challenges, which saw Venezuela try to get rulings annulledŌĆötribunals ordered Venezuela to pay approximately $8.7 billion to ConocoPhillips for its expropriated oil projects, according to Offshore Energy reports, and about $1.6 billion to ExxonMobil, according to Reuters.

These awards, which are yet to be paid in full, were a far drop from what each company was seekingŌĆöConocoPhillips wanted $30 billion and ExxonMobil wanted $10 billion in compensation.┬Ā

ConocoPhillips told Newsweek on Monday that it was “monitoring developments in Venezuela and their potential implications for global energy supply and stability,” but said “it would be premature to speculate on any future business activities or investments.”

Chevron, the only American firm currently operating in the country, told┬ĀNewsweek┬Āits current focus is “the safety and well-being of our employees, as well as the integrity of our assets.”

Trump told NBC News┬Ālast week that companies involved in any upcoming investment could be reimbursed by the government, if not through revenue, for the “tremendous amount of money” required to restore VenezuelaŌĆÖs oil sector. ŌĆ£But theyŌĆÖll do very well,ŌĆØ he said.

Venezuela is home to the largest proven reserves in the world but tapping into these largely dormant bounty is going to be ŌĆ£very difficult,ŌĆØ Rystad EnergyŌĆÖs chief economist Claudio Galimberti told Newsweek.

ŌĆ£The infrastructure is in a horrific state after decades of mismanagement, underinvestment, and flight of know-how,ŌĆØ he said. ŌĆ£Lots of investments are needed immediately, but thereŌĆÖs the chicken and egg problem: costs for new projects are very high due to lack of investment in the past 30 years, but investment wonŌĆÖt be made because costs are too high, and therefore returns are too low, especially in the current price environment.ŌĆØ

Galimberti made a similar point to Bolton’s, adding: ŌĆ£ThereŌĆÖs an additional hurdle: security and political stability.ŌĆØ

ŌĆ£The new government will need to ensure law and order are reestablished and that itŌĆÖs safe for foreign engineers and managers to work in the country,ŌĆØ he said. ŌĆ£The divestments by many International Oil Companies (IOCs) from places like sub-Saharan Africa over the past decade shows that law and order are critical conditions to be met for IOCs to operate in a country.ŌĆØ

Economist Carole Nakhle, from energy consultancy Crystol Energy, told Newsweek that current “political and regulatory uncertainty” could curb oil majors’ enthusiasm.

But she added that ŌĆ£while the financial commitment is significant, the rewards could be considerable.ŌĆØ

Trump seems to think oil companies will be prepared to take the risk, telling reporters at Mar-a-Lago on January 3: “We’re going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country.ŌĆØ

The news cycle is loud. Algorithms push us to extremes. In the middleŌĆöwhere facts, ideas and progress liveŌĆöthere’s a void. At Newsweek, we fill it with fearless, fair and fiercely independent journalism.

Common ground isn’t just possibleŌĆöit’s essential. Our readers reflect America’s diversity, united by a desire for thoughtful, unbiased news. Independent ratings confirm our approach: NewsGuard gives us 100/100 for reliability, and AllSides places us firmly in the political center.

In a polarized era, the center is dismissed as bland. Ours is different: The Courageous CenterŌĆöit’s not “both sides,” it’s sharp, challenging and alive with ideas. We follow facts, not factions. If that sounds like the kind of journalism you want to see thrive, we need you.

When you become a Newsweek Member, you support a mission to keep the center strong and vibrant.┬ĀMembers enjoy:

- ┬Ā Conventional Wisdom: Tracking political winds with clarity.

- ┬Ā Uncommon Knowledge: Deep dives into overlooked truths.

- ┬Ā Ad-free browsing and exclusive editor conversations.

Help keep the center courageous. Join today.

Read the full article here