The billionaire may have missed out on running DOGE, but thanks to his former pharma company’s banner year his fortune is up about 80%.

Vivek Ramaswamy bounces back quickly. He may have lost his bid for president in 2024 and been ejected from DOGE, Elon Musk’s government-slashing effort, in January 2025, but by February, the billionaire was in Cincinnati, Ohio to announce a bid for governor. “We’re on the cusp of a new golden age in America right now,” he told the crowd. “We will lead Ohio to be the top state in the country for capitalism and meritocracy.”

Capitalism has been good to Ramaswamy this year. In March, Forbes estimated his net worth at just about $1 billion, barely making our World Billionaires List. Today, he’s worth about $1.8 billion, an 80% increase in just nine months all while running for office.

He can thank his old pharmaceutical company, Roivant Sciences, for most of that jump. Ramaswamy founded the company in 2014—the same year he appeared on Forbes’ 30 Under 30 list—with the goal of buying drugs abandoned by pharma giants and unlocking their value. It had a rollercoaster of a start: A Roivant spinoff called Axovant that was testing an old Alzheimer’s drug went public in 2015 at a $3 billion valuation, but then its trials failed in 2017, tanking Axovant’s share price. Ramaswamy doesn’t appear to have ever sold any Axovant stock directly. He did unload part of his stake in Roivant before the hype faded, declaring capital gains of some $37 million on his 2015 tax returns, but told The New York Times in 2023 that he’d been “forced to sell” to make room for a new institutional investor. Had he held onto that stake, it’d likely be worth far more today.

He was able to attract more investors regardless, and soon Roivant’s drug pipeline began to pay off. The company sold five of its subsidiaries, plus 10% of the company at a $9 billion valuation, to Japanese conglomerate Sumitomo for $3 billion in 2019. Ramaswamy made out like a king that year, declaring over $170 million in capital gains on his 2020 tax returns. Today, both of Sumitomo’s top-selling drugs in North America came from Roivant: Orgovyx, which helps treat prostate cancer; and Gemtesa, a pill for overactive bladders.

Ramaswamy moved from CEO to chairman of Roivant in 2021, and the company went public via a SPAC merger soon afterwards. In early 2023, he left the board entirely to run for president. In October of that year, Roivant sold another spinoff, Telavant, to Swiss pharma company Roche for $7.1 billion, sending its stock up 34% by the end of the year. That helped secure Ramaswamy, who owned tens of millions of shares, his billion-dollar fortune.

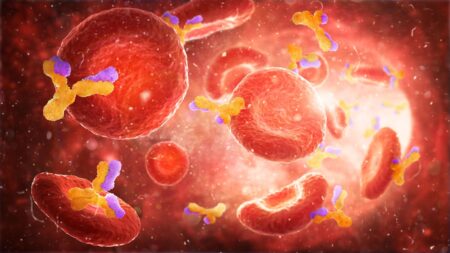

In September of this year, another of Roivant’s subsidiaries announced positive results in a Phase 3 trial for brepocitinib, a drug targeting the autoimmune disease dermatomyositis, which causes muscle weakness and skin lesions. Roivant’s stock soared again and is now up 33% since the announcement and 72% since the start of the year; Ramaswamy’s stake in the company, roughly 49 million shares, is now worth $1 billion on its own. His stock options, worthless earlier this year when the stock price was lower, currently add another $210 million to his fortune. “The company has thrived even in the years after I left,” Ramaswamy said at a Forbes 30 Under 30 event earlier this year, adding that he’s still in touch with Roivant’s current leadership.

A Ramaswamy spokesperson confirmed Forbes’ numbers as “broadly correct.” He noted that the billionaire also owns a stake in Chapter, a startup the candidate co-founded in 2020 that helps seniors navigate Medicare. Bloomberg reported in April that the company raised $75 million in Series D funding at a $1.5 billion valuation, and a person familiar with the company says Ramaswamy’s stake is worth about $100 million, or 6.7%.

Most of the rest of his portfolio is flat, despite some action under the hood. Strive Asset Management, the “anti-woke” investment firm he founded in 2022, pivoted to becoming a Bitcoin treasury company this year. It merged with publicly traded treasury Asset Entities in September, then announced another intended merger ten days later. Investors appear not to have loved the terms of the second, all-stock deal: Strive’s share price is down 74% since the announcement. Back when the company was private, Forbes estimated Ramaswamy’s stake at $150 million, and after the collapse in its share price his stake appears to be right around that point today. A smattering of other investments, including a small stake in the media company Buzzfeed, make up the rest of his fortune.

Meanwhile, Ramaswamy’s campaign for governor is raising plenty of money: $9.7 million through the end of July, according to the latest reports filed with Ohio’s secretary of state. That’s miles ahead of the $1.4 million raised by his most prominent Democratic opponent, Amy Acton, a physician who used to head Ohio’s health department. And unlike his run for president, into which he poured $26 million of his own money, Ramaswamy has only loaned his campaign about $200,000, a small fraction of his fortune.

Read the full article here