As the U.S. housing market remains frozen this winter, pending home sales have fallen in all but five of the 50 largest metropolitan areas in the country, according to the latest data by Redfin.┬Ā

Pending home sales indicate when a seller has accepted a buyerŌĆÖs offer, but the deal has not formally closed yetŌĆöwhich means the buyer still has a chance to back out, especially if they think a better chance might arise in the near future with lower borrowing costs or falling prices.┬Ā

Why It Matters

Among high housing and borrowing costs, U.S. would-be homebuyers have been withdrawing to the sidelines of the market over the past year, leading to a drop in demand and sale. This has led to a significant mismatch between buyers and sellers in the market, with the latter outnumbering the first by the hundreds of thousands.

While this gap is expected to slow down home price growth across the country and even lead to declining prices in parts of the country facing the highest supply of for-sale homes, buyers still appear reluctant to purchase a property nowŌĆöor willing to wait.

What To Know

At the national level, pending home sales were down 5.1 percent year-over-year in the four weeks ending February 8, the biggest decline since January 2025. In the same time frame, homes for sale spent 66 days on the market before going under contract, the longest time in six years.

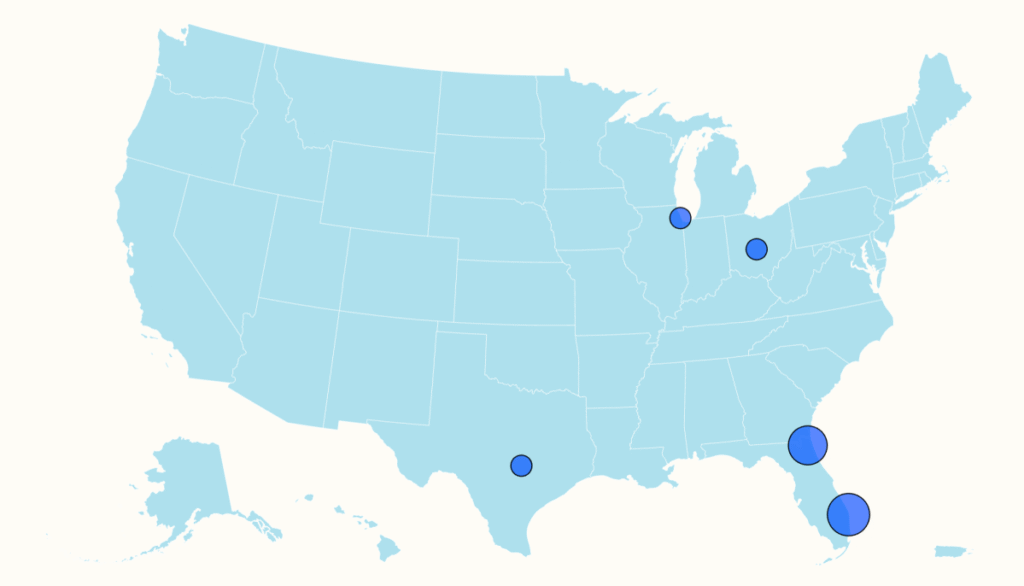

At the metro level, the biggest declines in pending home sales were reported in Oakland, California, down 21.6 percent in the four weeks ending February 8 compared to a year earlier, and Minneapolis, Minnesota, down 17.5 percent.

Pending home sales are falling and for-sale properties are taking longer to go under contract because housing costs remain high and AmericansŌĆÖ confidence about the economy and the stability of their jobs is faltering, according to experts.

The median home sale price was up 1.2 percent year-over-year in the four weeks ending on February 8. While mortgage rates have come down from their peak and are now near the 6 percent mark, they are still double the pandemic era lows which sparked a home-buying frenzy across the country.

The number of homes available on the market is also dwindling after steadily rising for the past year, contributing to slow down price growth. New listings fell 1.8 percent year-over-year in the four weeks ending February 8, and the total number of homes for sale dropped by roughly 1 percent. It was the first decline since 2023, according to Redfin.

In the former pandemic boomtown of Austin, which has experienced one of the deepest corrections in the nation over the past couple of years, pending home sales were flat.

In only four cities they were actually higher year-over-year in the four weeks ending on February 8. These were West Palm Beach, FL (9.1 percent), Jacksonville, FL (7.7 percent), Columbus, OH (1.4 percent), and Chicago (0.1 percent).

Austin and Jacksonville were among the five metros with the biggest year-over-year declines in median sale prices in the same period. In Austin, the median sale price of a home fell by 4.3 percent, second only to Fort LauderdaleŌĆÖs year-over-year drop of 6.4 percent. In Jacksonville, the median sale price fell by 3.9 percent.

The last time pending sales increased in 4 or fewer regions was the end of 2023, according to Redfin.

What People Are Saying

Sue Dhillon, a Redfin Premier agent in Seattle, said in a statement included in the latest report: “ItŌĆÖs still a buyerŌĆÖs market, but it might not be for long.┬Ā

“House hunters are getting a jump start on the spring selling season because theyŌĆÖre doing the math and realizing that a few things are working in their favor: sellers are pricing lower, mortgage rates have come down slightly and arenŌĆÖt likely to drop further any time soon, and rents just keep climbing. If buyers wait any longer, competition is likely to pick up.”

What Happens Next

Experts expect the U.S. housing market to pick up in spring, what is traditionally considered home-buying season, especially as affordability is improving as wages are growing faster than home prices.

“Buyers will find a more favorable market as we head into spring,” Bright MLS Chief Economist Lisa Sturtevant said in a statement shared with Newsweek.

“More inventory, lower rates and slower price growth will give buyers more room for negotiation. Snowy weather in January could have delayed buyers a bit, but it is likely we will see more home shoppers out early this spring,” she said.

Read the full article here