Databricks and Perplexity cofounder Andy Konwinski, early backer Pete Sonsini and Antimatter CEO Andrew Krioukov have launched Laude Ventures, a seed-stage firm focused on research-driven, highly-technical founders at their alma mater UC Berkeley and elsewhere.

Perplexity AI CEO Aravind Srinivas was trying to relax over a cup at the Blue Bottle Coffee in downtown Palo Alto in February 2023, when he opened a troubling link. Srinivas had just reached a handshake deal with a venture capitalist, NEA general partner Pete Sonsini, to lead a Series A funding round in his search engine startup. But The Verge had published screenshots of what appeared to be a threat: a rumored integration of OpenAI’s chatbot, ChatGPT, into Microsoft’s search engine, Bing.

Within hours, another prospective investor sent Srinivas an updated term sheet to extend the period of due diligence on any commitment, an ominous sign. When Sonsini called the next morning, Srinivas braced for more disappointment. But despite his partnership’s concerns about the news, Sonsini wouldn’t go back on his promise, he said. Sonsini and NEA led a $26 million Series A funding round in Perplexity announced that March, valuing the year-old business at more than $100 million.

“It was very honorable, not how Silicon Valley is portrayed in TV shows,” Srinivas said. “It was old school, where your word is your word.”

After Sonsini left NEA just a few months later, it was Srinivas’ chance to return the favor. He made room for Sonsini’s fledgling new firm, Laude Ventures, in Perplexity’s hotly competitive raise at a $1 billion valuation in January. With Perplexity now reported to be raising funding at a $9 billion valuation, Laude’s first check is already tracking to return its capital nine times over in a matter of months. (In June, Forbes sent Perplexity a cease and desist after accusing the startup of using its reporting without permission.)

“I like working with Pete,” Srinivas told Forbes. “When he decided to do new things, I wanted to be supportive.”

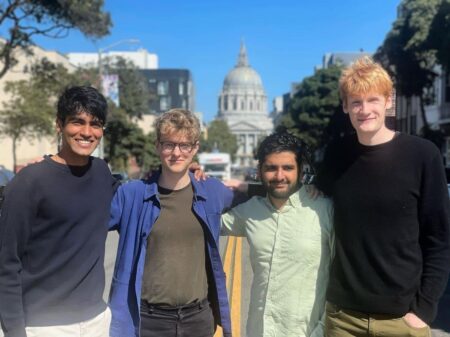

Deep ties to the tech research community and technically minded founders like Srinivas are the early calling cards for Sonsini and Laude Ventures, which has closed a $150 million first fund to invest in pre-seed and seed stage startups. The equal partnership consists of Sonsini, Databricks cofounder Andy Konwinski and Berkeley PhD Andrew Krioukov.

Laude will look to leverage the partners’ ties to UC Berkeley’s research labs — whose alums founded both Databricks, reported to be raising at a $55 billion valuation, and Perplexity — but its network extends beyond: more than 50 leaders in computer science and AI are personal investors in the fund, including Databricks cofounders Ali Ghodsi and Ion Stoica, Srinivas at Perplexity, as well as Google Chief Scientist Jeff Dean, with whom Konwinski and others recently published a vision paper on the future of AI impact. A first close of $75 million was reported by The Wall Street Journal in May.

Laude’s partners hope to back about 25 companies with their first fund. They’ve invested in four companies so far, including Perplexity, GPU cloud provider Foundry and not-yet-launched data startup Tabsdata.

“Entrepreneurs powered by research can build the biggest outcomes and really change the world,” Sonsini told Forbes. “It’s what we love to do.”

The origins of Laude’s partnership trace back to UC Berkeley, where seven PhD candidates including Konwinski cofounded enterprise software business Databricks in 2013. Sonsini, the son of famed tech lawyer Larry Sonsini and himself a Berkeley graduate, was the startup’s second investor, having previously worked with founding CEO Ion Stoica at his previous startup backed by NEA, Conviva.

In Databricks’ early years, Konwinski was known for taking charge of popularizing Apache Spark, the open-source analytics engine for working with large amounts of data around which Databricks was built, hosting events and engaging with developers. “He’s that guy who will ask you, ‘have you seen this cool thing X?’ And you’re like, ‘no, what is it?’” said Ghodsi, Databricks’ CEO. “And then six months later you’ll hear everybody talking about how X is the coolest thing ever. But by then, Andy’s on to the next thing.”

But two years into Databricks’ existence, the startup was struggling to find new investors when, as detailed in a Forbes magazine feature in 2021, Sonsini stepped up to invest again on behalf of NEA. “In the bad times, he doesn’t overreact,” said Stoica, who has since worked with Sonsini on a third startup, distributed programming business Anyscale. “He’s loyal in a way that is rare for investors.”

When Konwinski left day-to-day operations at Databricks in 2019, he started personally investing in startups alongside Krioukov, a longtime friend from their undergraduate days at the University of Wisconsin who had also rubbed shoulders with the Databricks crew as a PhD student at Berkeley. More interested in energy and climate change concerns, Krioukov had cofounded Comfy, a business to help manage office lighting and temperature, for which he appeared on the Forbes 30 Under 30 list for Energy and Industry in 2014. The startup was acquired by Siemens in 2018.

Already backing their classmates ad hoc, Krioukov and Konwinski ran a simulation that found that if they had invested in every research-driven startup to come out of their Berkeley lab over the previous years, they would have seen a 28x return on their capital – or 9x even without Databricks. Next, they convinced 25 of their former classmates and professors in the tech industry to invest in a fund, Computer Science Graduate Ventures, focused on that thesis.

It was Krioukov and Konwinski who first found Srinivas, another Berkeley PhD, while he was still a research scientist at OpenAI. After investing, Konwinski introduced Srinivas to his first engineer hire, as well as Sonsini, who had invested in Krioukov’s most recent startup, data security provider Antimatter. Konwinski spent four months working closely with the startup on everything from incorporation and immigration documents, leading Srinivas to name him another cofounder of the business.

Perplexity’s president and still a board director, Konwinski was ready to step back again after Perplexity achieved early product market fit. “Once we found it, I knew that my specialization was going to be to go do that again,” he said. “Finding very early founders, you can help them through those nascent moments, to help them avoid stepping on landmines.”

After writing eight checks into Perplexity and others, CSGV’s fund is on track to return its $4 million at least 20 times over, meaning about $80 million in paper profits. Its partners were discussing raising a second fund when the news broke that Sonsini was departing NEA as part of a leadership shuffle first reported by Forbes.

“We wanted to back folks coming out of deeply technical, research backgrounds, and Pete had been doing that for two decades already,” said Krioukov, who will work part-time on Laude while continuing to lead Antimatter as CEO.

Though not explicitly an AI-focused firm, Laude will be likely to invest in startups at least related to the field in some way, its partners said, in areas such as infrastructure, data analytics and virtualization. Its partners hope to leverage their supporters, former investments and the research community for opportunities. “We don’t think of companies as AI or non-AI,” Krioukov said.

At Tabsdata, cofounder and CEO Arvind Prabhakar noted that Sonsini had served as a board director at his prior startup, which he sold in 2022 to Software AG (it’s now part of IBM). Laude won out to lead an investment over other firms, Prabhakar said, for its combination of strategic venture experience with go-to market chops. “At this stage, you are so early in the game that you want people who are connected to the ground, able to guide you and help you,” he said.

Whether Sonsini, Konwinski and Krioukov can achieve elite venture returns from their heavily overlapping networks, however, isn’t guaranteed. Perplexity’s reported $9 billion valuation would mean CSGV’s original fund, now managed by Laude, stands up 50x; at a $55 billion valuation, NEA’s 11% historical stake in Databricks, meanwhile, would be worth more than $5 billion, not adjusting for dilution. But while Sonsini’s NEA investments stood at 7x their initial capital as of earlier this year, at least one prospective limited partner said they hadn’t pursued an investment in Laude out of concern that both deals were unrepeatable outliers.

Laude responded that Sonsini was also a seed investor in two unicorns, Stoica’s Anyscale and Instabase, while bringing in several other promising bets. And Amit Bhatti, an investor in Laude on behalf of TrueBridge Capital Partners (a Forbes data partner on several lists) said that the combined track records of the firm’s three partners made them “a rare combination” that founders would seek out. “There’s no doubt given what they’ve done already that they’re well suited to this,” Bhatti said.

Sonsini argued that Laude was already holding its own against more established funds. “We’ve already beat top firms to deals, and I’m very confident we’ll do well,” he said. “It’s more fun doing this as a group that can win together as a team.”

Read the full article here