A GOP lawmaker has proposed legislation that would impose a 25% excise tax on payments for outsourced services, aiming to encourage companies to keep jobs in the United States.

The Halting International Relocation of Employment Act (HIRE Act), introduced by Republican Senator Bernie Moreno of Ohio, would also bar companies from deducting those outsourcing payments and funnel revenues into a new “Domestic Workforce Fund” to support U.S. workers and apprenticeship programs.

“While college grads in America struggle to find work, globalist politicians and C-Suite executives have spent decades shipping good-paying jobs overseas in pursuit of slave wages and immense profits—those days are over,” Moreno said in a press release.

However, an Indian MP has warned that the country’s IT sector could be adversely affected by the proposed legislation.

Newsweek has contacted Senator Moreno’s office for further comment via email outside office hours.

Why It Matters

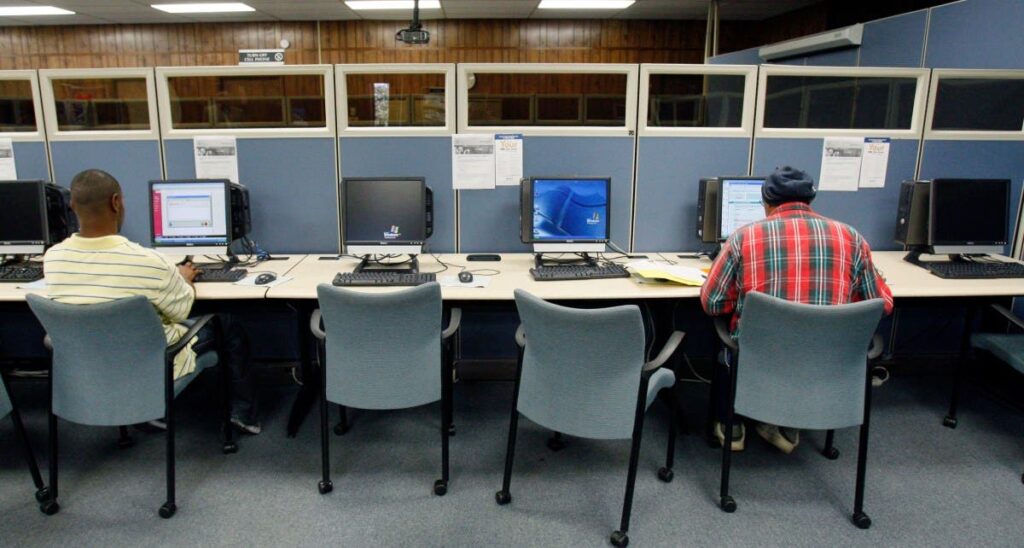

The HIRE Act could have major implications for India, where the IT and business services sector relies heavily on contracts with U.S. clients. A 25% tax on outsourced payments could disrupt these contracts, raise costs for U.S. companies, and potentially threaten thousands of jobs in India’s tech industry. Outsourcing refers to the practice of a company hiring external or foreign firms to handle certain business functions or services, such as IT support, customer service, or consulting, instead of performing them in-house.

What To Know

The legislation defines outsourcing broadly, covering “any premium, fee, royalty, service charge, or other payment” made to foreign entities for labor or services that ultimately benefit U.S. consumers.

So far, Moreno appears to be the bill’s principal sponsor, and the measure faces long odds and likely heavy amendment in committee, as tax legislation with broad international implications typically invites extensive review.

The plan has raised alarm in India, where outsourcing accounts for a large portion of the IT and business-services sector. Indian MP Jairam Ramesh said the proposal “has a direct and deep impact on India’s IT services,” warning that it could disrupt contracts, raise costs for clients, and threaten jobs in the IT sector.

“If ever HIRE becomes a reality it will light a fire in the Indian economy which may have to face a new normal in relation to the US,” Ramesh said in a post on X.

India’s IT and business process sectors, which together make up a significant share of the country’s services exports and employ millions, could see projects repriced, contract durations shortened, or a shift toward onshore or nearshore alternatives depending on how clients respond. Some firms might absorb some of the additional cost, others could raise prices, and still others could look to jurisdictions or contractual structures that minimize U.S. tax exposure, a possibility the bill’s authors sought to guard against through regulatory anti-avoidance language.

What People Are Saying

Republican Senator Bernie Moreno of Ohio said in a press release: “It’s time to fight for working-class Americans and ensure they can work and retire with dignity. If companies want to hire foreign workers instead of Americans, my bill will hit them where it hurts: their pocketbooks.”

Jairam Ramesh wrote in a post on X: “Other countries like Ireland, Israel, and Philippines too will be impacted but the maximum effect will be on India’s exports of services which has been a marked success story over the past quarter of a century. The Bill in its present form may or may not pass. It may get modified. It may just linger. But one thing is clear—the Bill reflects a growing mindset in the US that while blue-collar jobs were ‘lost’ to China, white-collar jobs should not be ‘lost to India.’ Nobody expected a year ago that the India-US economic relationship will take so many knocks—of which the HIRE Bill is another reflection.

What Happens Next

If passed in the GOP-controlled Congress, the law would apply the tax and deny deductions for outsourcing payments made after December 31, 2025.

Read the full article here