UPDATE, November 19, 2024: Private equity firm Blackstone announced it reached an agreement with Jersey Mike’s owner Peter Cancro to acquire a majority of the sandwich chain. The deal is reported to value Jersey Mike’s at $8 billion including debt. Cancro is retaining a minority stake in the company, according to Blackstone’s announcement. Forbes has not yet been able to confirm Cancro’s exact stake moving forward.

“We believe we are still in the early innings of Jersey Mike’s growth story and that Blackstone is the right partner to help us reach even greater heights,” Cancro said in a press release about the deal. “Blackstone has helped drive the success of some of the most iconic franchise businesses globally and we look forward to working with them to help make significant new investments going forward.”

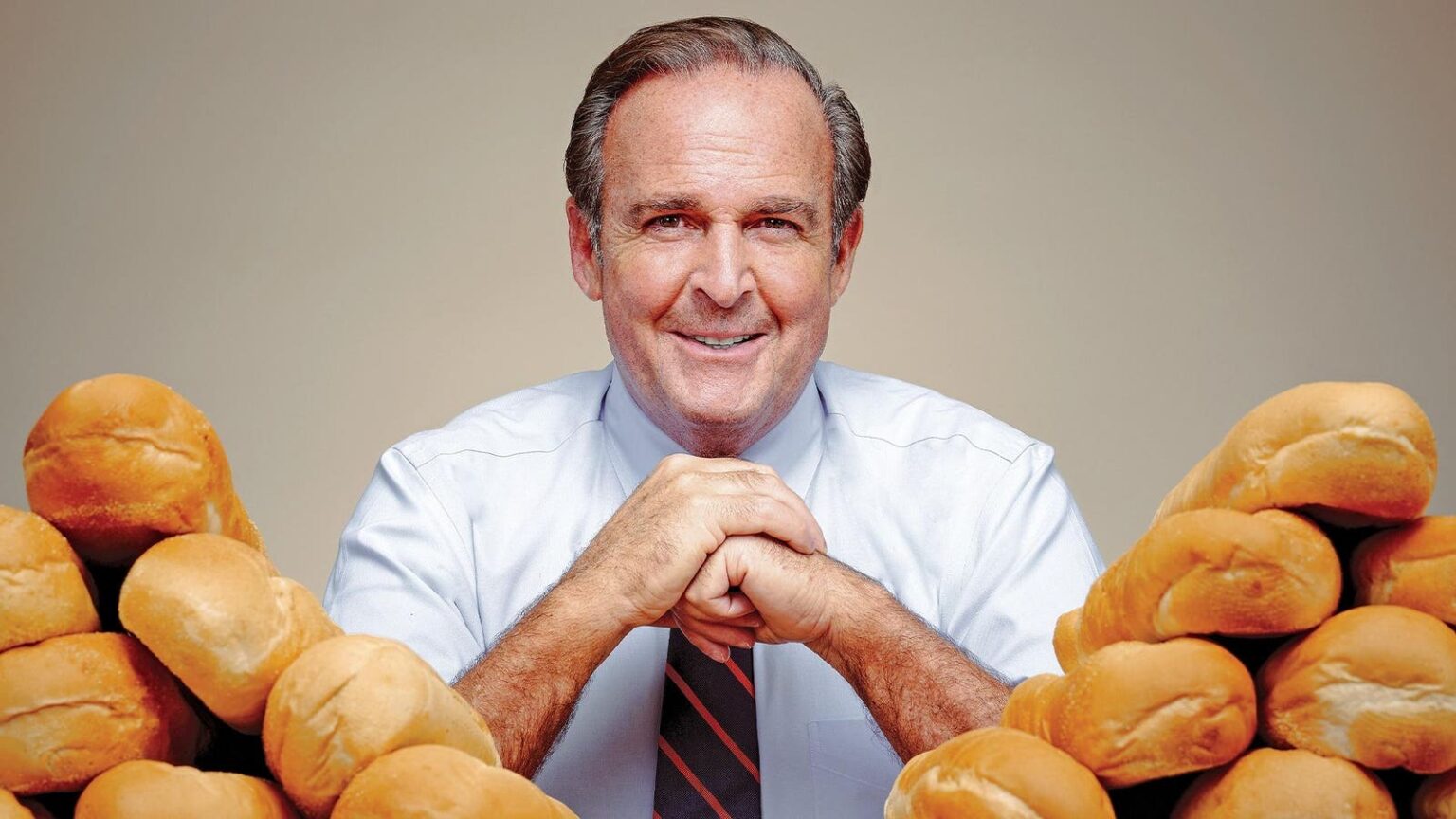

When Forbes visited Jersey Mike’s owner Peter Cancro on the Jersey Shore earlier this year, he was coy about whether or not he was close to selling his popular 68-year old sandwich chain. By then, there were already rumors that private equity giant Blackstone was interested in buying out Cancro. The entrepreneur didn’t deny the talks but claimed the parties had never come close to a deal.

“I’ve worked my whole life to be right where we are right now, and things have just started to grow, believe it or not,” Cancro said when asked about possible plans to sell. “Am I going to be here 40 years from now? Probably not.”

Turns out he barely made it over four months. According to multiple reports on Monday, Jersey Mike’s is nearing a deal to sell itself to Blackstone. The Wall Street Journal, which was first to report the news, said the deal may value Jersey Mike’s at $8 billion including debt, a sum that’s quite close to the $9 billion its much bigger rival Subway fetched in April. Reuters, meanwhile, reported the sale could close as soon as this week.

The reported $8 billion offer is roughly 60% higher than Forbes’ $5 billion estimate in the summer. One reason for the high price tag is its “much stronger store model” than Subway’s, according to restaurant industry analyst John Gordon. The number also includes expected international growth, he adds.

Representatives for Jersey Mike’s and Blackstone could not immediately be reached by Forbes for comment.

If the sale goes through, it would mark a huge change for the sandwich chain that has been 100% owned by entrepreneur Peter Cancro since 1975. Not only would Cancro’s net worth jump to $6.6 billion in nearly all cash, up from $5.6 billion, but the business would go from sole proprietor running the business along with several family member and longtime friends to one run by a massive $220 billion investment powerhouse.

Cancro, a Jersey Shore native, bought the sandwich shop where he worked as a teenager with a $125,000 loan from his football coach. He then built it over the decades into a national brand with more than 3,000 locations, as Forbes detailed in a July magazine cover story featuring Cancro.

Part of its appeal has been its ability to keep its mom and pop feel. “People see us as the local sub shop. They don’t consider us a chain,” Cancro told Forbes.

While multiple industry experts predicted significant massive changes for Jersey Mike’s if a deal went through, the chain’s insiders brushed off concerns that their eateries would lose their familiar feel. “Any buyer would be foolish to change the culture of this company,” said Jersey Mike’s COO Mike Manzo in a June interview. “Why would you change the culture? The numbers speak for themselves?”

Cancro had a different reply but was just as bullish, particularly about why he believed Blackstone would preserve his brand, It’s “an unbelievable group, great people,” he said about the Blackstone executives. “And that’s the thing, you’ve got to make sure they share your culture and anybody if they do acquire this company, whoever may someday, we’ve got great people in place.”

He also pointed to Domino’s Pizza as an example. Monaghan sold his more than 90% stake in Domino’s to Bain Capital in a nearly $1 billion deal in 1998, and that brand has thrived, Cancro says. “People sell all the time and it goes well,” he told Forbes.

Read the full article here