The big keep getting bigger, until they don’t. Since nothing grows to the moon, in the markets there always comes a time when momentum reverses sharply, and the unloved become loved and the loved become hated. In the dot-com crash, the signs of an impending recession resulted in high flying dot-com stocks getting walloped, many losing 90% or more of their value in a year, as smaller businesses and companies held their own. The reversal of fortunes not only applied to the different sectors within the US markets, but also to global markets. Emerging market stocks took off, and outperformed their developed market counterparts for close to a decade that followed.

The most recent inflation data today resulted in small cap stocks, as measured by the Russell 2000 index, severely outperforming large cap tech stocks as measured by the S&P 500 and NASDAQ. At the end of the day, the small-cap stock Russell 2000 index and an ETF that tracks is (IWM) were up more than 3.5% while the Nasdaq and the QQQ ETF were down over 2.0% (Source: Bloomberg). An almost 6% outperformance in one day, in opposite directions. Something we have not seen in a while. An anomaly or a canary in the coalmine?

Going into today’s inflation release, the market was expecting a month-over-month rise in inflation of +0.1%. The actual release showed it to have fallen by the same magnitude; i.e. minus 0.1%. While inflation year over year is still running at 3%, which is higher than the Fed’s goal of 2%, this surprise was enough to start a vicious rotation into small caps at the expense of large cap tech stocks. For the last couple of years, the haves — i.e., large mega-cap tech stocks such as NVDA, AAPL, AMZN, MSFT, NFLX, GOOG, FB (the original FAANGs + one) — have been rallying despite higher interest rates, while the rest of the stock market has languished. Flush with the cash thrown at them during COVID courtesy of a generous government, the public spent money on the stuff that the large cap firms make; e.g. phones that cost close to $2,000, or multiple daily deliveries of boxes from Amazon. This resulted in massive cash hoards for the large-cap tech firms, that they spent both on record buybacks, resulting in a massive short squeeze of sorts on their stock prices. They also earned 5%+ on their cash hoards, which they paid out as small dividends to reward shareholders to keep them faithful. On the other hand, the small-capitalization stocks, with a few exceptions (such as GME, AMC and other meme favorites) went through a boom-and-bust cycle and were left with little cash and high interest costs. They just experienced an existential risk period, where for many their survival came into question. Some others were lucky to get caught up in the AI frenzy (e.g. SMCI), and just in time graduated to the S&P 500, which is like getting a free ticket on the express train, because passive indexed money keeps flowing into the S&P 500.

The market has fantasized a Fed ease many times earlier this year, but all of it so far has come to nothing, as inflation picked up and the rate cut hopes were dashed. A sharp, unexpected fall in inflation today was what was needed to improve the odds of an actual cut, and the latest inflation report showed just that. Indeed, Chair Jerome Powell’s testimony a couple of days ago which indicated a “balanced” picture amplified the view that the Fed is looking for a reason to cut interest rates. So, rate cuts later this year are back on the table. And as a corollary, a weakening economy and falling inflation is relatively bad news for the mega-cap tech stocks.

Our closest analog, on which we reported last month (see “Is The Stock Market In A Bubble?”), is the dot-com bust of 1999-2000. Famously CSCO rose over 500% even in the face of rising rates and then collapsed 90% all within a couple of years, and the “this time is different” stories turned out to be nothing but fantasy. We could be in a similar situation today. Falling inflation and a slowing economy then resulted in the question: “who will buy all this stuff if the economy falls off the cliff”? The answer was – no one. In the aftermath of the dotcom bust the overhang of too much bad investment resulted in good companies being sold at cheap prices (and bad companies going bust), which resulted in substantial gains to those who had not gotten caught up in the hype and maintained their liquidity. The Fed reacted by cutting rates aggressively, but it was too late for the high-flying tech stocks (Fed Fund rates were slashed from above 6% to 1% over the next few years) but good for the smaller cap stocks that had languished.

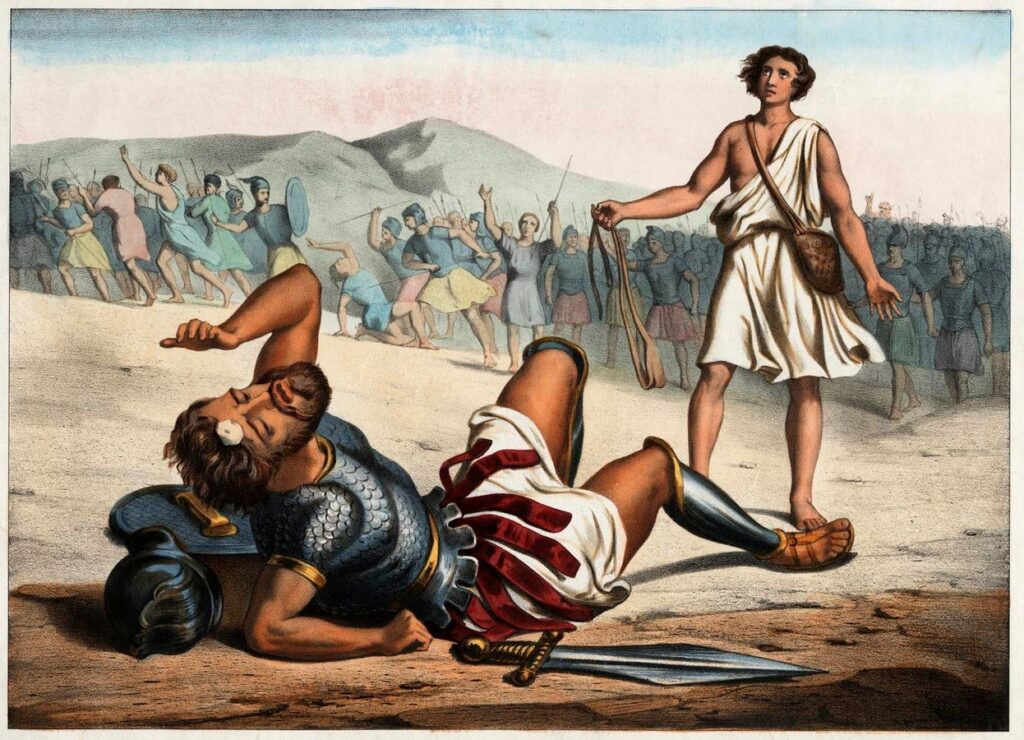

Putting this together, we can now see that the dismal performance of the small caps compared to the stellar performance of the large caps until today is partially explained by something as simple as the short rate. Once short rates fall, especially because the macroeconomic conditions change, the playing field is leveled. Not only the cost of financing is lower for the small caps, but also the extra money that the large caps can earn by depositing it into T-bills goes down. Whether or not one inflation print will be enough to turn the tide, the exposure of the market is now clear for everyone to see. Falling inflation, weakening economic conditions, and a possible rate cut can be the little stone in the sling that David uses to fell Goliath , as during the dot-com bust. If one economic number can become the catalyst for a change in the big picture, today’s inflation release certainly seemed to have done that job. Now it remains to be seen if this event reversed the trend of mega cap supremacy for good or if it was just a blip we will forget. Something seems to be afoot.

Read the full article here