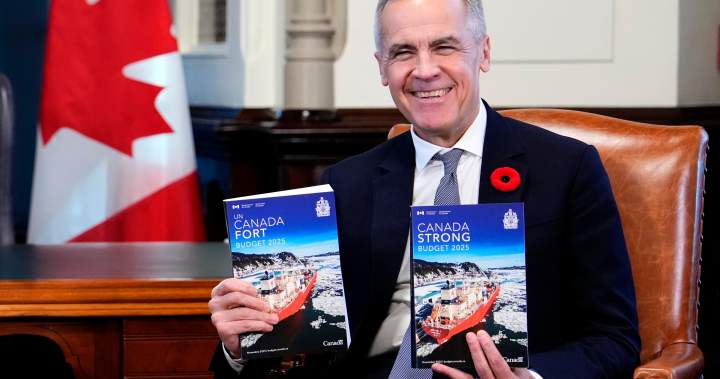

Prime Minister Mark Carney tabled his government’s first budget in the House of Commons on Tuesday, and included in the plan are several changes to taxes for Canadians and businesses.

Among the proposals are automatic tax filing for low-income Canadians, eliminating “double dipping” among some who claim two types of tax credits for the same renovation projects, and a lowering of the effective corporate tax rate for eligible businesses.

Here’s what we know about the plans.

Budget 2025 also proposed introduce automatic tax filing for low-income Canadians.

The measure will apply to Canadians whose income is below the federal basic personal amount or provincial equivalent and who the government says are missing out on rebates and support programs that are calculated and delivered using tax filing records.

The individuals will be sent their tax information by the Canada Revenue Agency (CRA), after which they will have 90 days to file their tax returns.

If they do not do so, the CRA can file the tax returns on their behalf.

In order to spur investment and competition with the U.S., the budget proposes a “super-reduction” of more than two percentage points to Canada’s marginal effective tax rate for corporations.

The cut, which will bring that tax rate for eligible corporations down to 13.2 per cent overall, would put Canada further below the U.S. rate and the OECD average.

The rate will also dip below the U.S. across all major economic sectors following the cut, according to the budget.

On Tuesday, the budget introduced a “temporary, non-refundable Top-Up Tax Credit.”

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

This would apply to people whose non-refundable credits exceed the first tax bracket and who could owe more tax due to the reduction of the first personal tax rate and related credit rate earlier this year.

Back in May, the Carney government lowered the lowest marginal personal income tax rate from 15 per cent to 14 per cent, touting it as a middle class tax cut.

“When the government lowered the first tax bracket, that also reduced the value of various non-refundable credits,” said Jamie Golombek, managing director of tax and estate planning with CIBC Private Wealth.

The government estimated that it would end up saving $27 billion for Canadians, but for some Canadians, it meant they lost out on some tax credits.

“The measure would benefit a small number of individuals who claim very large non-refundable tax credits that exceed the top of the first bracket threshold ($57,375 in 2025),” the budget document said.

The budget also introduced a federal tax credit for personal support workers.

Similar credits are already available for personal support workers in British Columbia, Newfoundland and Labrador and the Northwest Territories.

Under the measures announced in the budget, eligible personal support workers employed in the remaining provinces and territories could claim a refundable tax credit equal to five per cent of their eligible earnings, providing support of up to $1,100 per year.

John Oakey, vice-president of Taxation with Chartered Professional Accountants of Canada, said it remains to be seen how eligibility will be defined.

“When we talk about eligibility, and we’re talking about personal care workers, it’s difficult to define,” Oakey said.

“We’re going to have to see how well that’s defined and are there going to be people that consider themselves personal care workers that don’t seem to fit within the definitions that are provided.”

One change in the budget will mean seniors or some Canadians with disabilities can no longer claim two separate tax credits for the same expense.

The Home Accessibility Tax Credit (HATC) is a non-refundable tax credit that applies at the lowest personal income tax rate on up to $20,000 of eligible home renovation or alteration expenses per calendar year.

The Medical Expense Tax Credit is a non-refundable tax credit that applies at the lowest personal income tax rate on the amount of qualifying medical and disability-related expenses in excess of the lesser of $2,834 (for 2025) and 3 per cent of the claimant’s net income, the budget document said.

There are certain renovations that can qualify for the medical expense tax credit (METC). Currently, if an expense qualifies for both, Canadians have been able to claim tax credit on both.

Budget 2025 proposes to amend the Income Tax Act “such that an expense claimed under the Medical Expense Tax Credit cannot also be claimed under the Home Accessibility Tax Credit.”

This change will apply starting 2026.

“If you have the opportunity to spend that money before the end of this year, you get a double credit. Starting Jan. 1, you will not be allowed to double dip. In other words, any expense that you claim as a medical expense will not also be eligible for the home, accessibility tax credits,” Golombek said.

For the average person, there are no changes to the capital gains tax system.

In March, the Carney government cancelled the capital gains inclusion rate hike, which was proposed by the previous Trudeau government.

The Canadian Entrepreneurs’ Incentive, a tax credit introduced to offset losses to small businesses, will now be cancelled under Budget 2025.

“The estimates for cancelling the proposed capital gains tax increase also include the cancellation of the Canadian Entrepreneurs’ Incentive,” the budget document said.

“This was a special incentive for qualifying business owners who sold the business, providing a reduced capital gains tax rate on up to $2 million over a five-year phase-in,” Golombek said.

“It’s going to be $400,000 this year, going up to two million dollars in five years. If you sold your business, you’d have a reduced capital gains rate. That has been scrapped altogether,” he said.

Oakey said the change was “logical.”

“It does make logical sense because it was brought in as part of a package to mitigate the increase in the capital gains tax rate. If we’re not going to have an increase in the capital gains tax, then it makes sense that we don’t necessarily need to have the Canadian entrepreneur incentive,” he said, adding that the incentive only added complexity to the system.

At least two major taxes got the axe in Tuesday’s budget.

The government is proposing to eliminate the “inefficient” Underused Housing Tax and the luxury tax on private aircraft and vessels, which the budget says “will result in administrative savings” for the Canada Revenue Agency.

The Underused Housing Tax, enacted in 2022, adds an additional one per cent federal tax on the ownership of vacant or underused housing in an effort to crack down on foreign ownership by non-residents.

The luxury tax, which still applies to luxury vehicle purchases over $100,000, was updated in 2023 to apply to certain vessels like yachts and sailboats, as well as private jets, helicopters and seaplanes.

The budget says that “to provide relief to the aviation and boating industries and increase the overall efficiency of the luxury tax framework, Budget 2025 announces the government’s intention to end the luxury tax on aircraft and vessels as of the day after Budget Day.”

–with files from Global’s Sean Boynton

Read the full article here