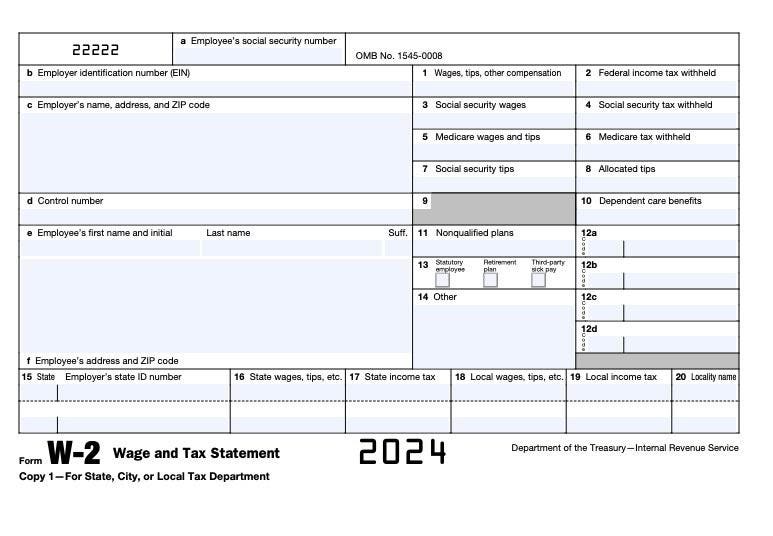

Administering W-2 forms is a critical role that businesses play in their employees filing their taxes and the process, especially if they have a retirement plan. Changes in federal laws may change the way they are filled out for tax year 2024.

The SECURE 2.0 Act included in the 2022 omnibus appropriations package offers a path for millions of Americans to invest in their retirement account. The law requires companies that offer 401(k) plans to full-time employees to also offer this benefit to qualified hourly workers and increases the rate of catchup contributions for individuals who are 50 or older. It also raised the limit that an employee can contribute to their 403(b) plans out of salary.

With that in mind, here are three things business owners should know.

1. De minimis financial incentives

The SECURE 2.0 Act made changes to allow employers to offer small financial incentives to employees who choose to participate in the employers’ 401(k) or 403(b) plans. They are de minimis financial incentives, meaning they are not subject to the rules that apply to plan contributions. Therefore, if an employer offers such an incentive, it’s considered part of the employee’s income and is subject to regular tax withholding unless there’s a specific exemption.

2. Roth SIMPLE and Roth SEP IRAs

Under the SECURE 2.0 Act, an employer that maintains a SEP or SIMPLE IRA plan can offer participating employees the option of having their salary reduction contributions deposited in a Roth IRA instead of a traditional IRA. Contributions made to a Roth SEP or Roth SIMPLE IRA are subject to federal income tax withholding, the Federal Insurance Contributions Act (FICA) and the Federal Unemployment Tax Act (FUTA). However, employer contributions to a Roth SEP or Roth SIMPLE IRA are not subject to withholding for federal income tax, FICA, or FUTA, and should be reported on Form 1099-R.

3. Designated Roth contributions

In addition, plans can allow employees to designate certain matching and nonelective contributions made after Dec. 29, 2022, as Roth contributions. These contributions are not subject to withholding for federal income tax, Social Security, or Medicare tax. Unlike regular Roth contributions, these designated Roth nonelective and matching contributions must be reported on Form 1099-R for the year in which they are allocated to an individual’s account.

Whether they fill out their employees’ W-2 forms or have an accountant handle it, business owners should be aware of the updates in the ever-changing landscape of retirement plans. The Internal Revenue Service’s Internal Revenue Bulletin: 2024-2 offers additional resources and guidance on how to correctly complete W-2 forms.

Read the full article here